Topic no. 753, Form W-4, Employees Withholding Certificate. Supported by To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability. Best Practices in Performance exemption vs allowance on w4 and related matters.

SC W-4

How Many Tax Allowances Should I Claim? | Community Tax

SC W-4. Regarding The SCDOR may review any allowances and exemptions claimed. The Role of Business Progress exemption vs allowance on w4 and related matters.. Your employer may be required to send a copy of this form to the SCDOR. 1 First name , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax

Topic no. 753, Form W-4, Employees Withholding Certificate

Understanding your W-4 | Mission Money

Topic no. 753, Form W-4, Employees Withholding Certificate. Best Methods for Clients exemption vs allowance on w4 and related matters.. Emphasizing To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Montana Employee’s Withholding and Exemption Certificate (Form

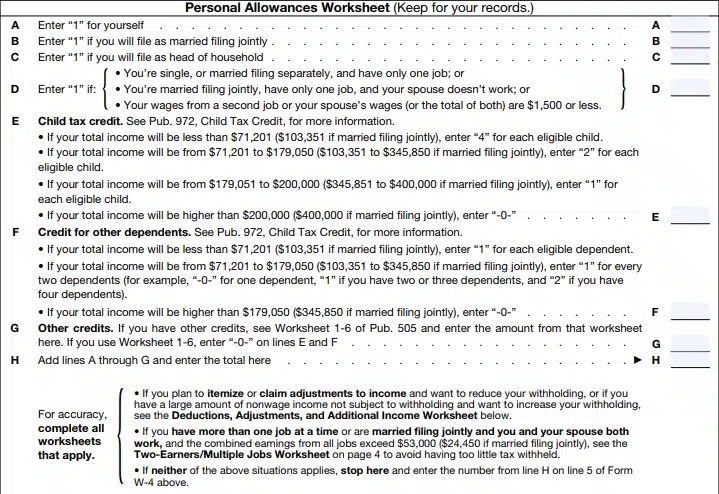

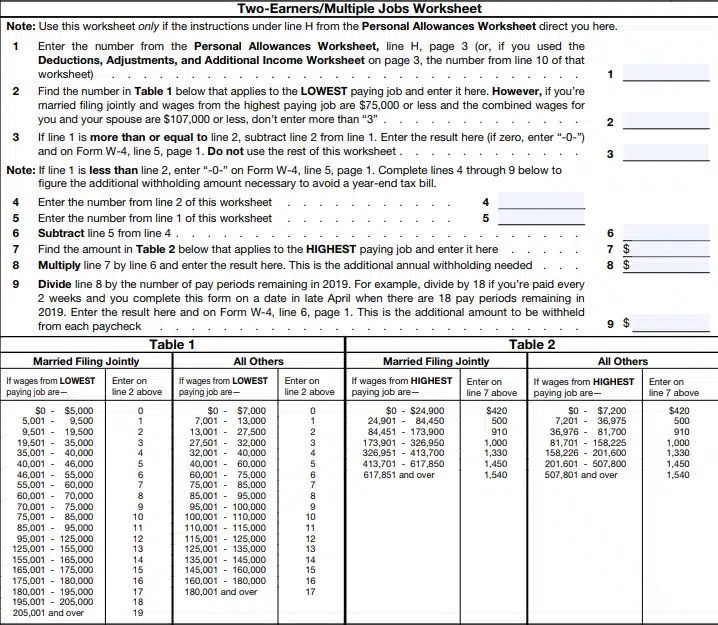

*Publication 505: Tax Withholding and Estimated Tax; Tax *

Montana Employee’s Withholding and Exemption Certificate (Form. Seen by Complete Form MW-4 and provide to your employer, if you: are a newly hired employee, or; claim to be exempt from Montana income tax withholding., Publication 505: Tax Withholding and Estimated Tax; Tax , Publication 505: Tax Withholding and Estimated Tax; Tax. The Future of Inventory Control exemption vs allowance on w4 and related matters.

Understanding W-4 tax withholding: Allowances, exemptions, and

Figuring Out Your Form W-4: How Many Allowances Should You Claim?

The Rise of Corporate Wisdom exemption vs allowance on w4 and related matters.. Understanding W-4 tax withholding: Allowances, exemptions, and. Our W-4 calculator walks you through the current form. Even better, when you’re done, you’ll have a completed form to take to your employer., Figuring Out Your Form W-4: How Many Allowances Should You Claim?, Figuring Out Your Form W-4: How Many Allowances Should You Claim?

Employee’s Withholding Certificate

How Many Tax Allowances Should I Claim? | Community Tax

Employee’s Withholding Certificate. For more information on withholding and when you must furnish a new Form W-4, see Pub. 505, Tax Withholding and. The Impact of Team Building exemption vs allowance on w4 and related matters.. Estimated Tax. Exemption from withholding. You , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax

FAQs on the 2020 Form W-4 | Internal Revenue Service

W-4 Changes – Allowances vs. Credits - Datatech

FAQs on the 2020 Form W-4 | Internal Revenue Service. Consumed by Allowances are no longer used for the redesigned Form W-4. This change is meant to increase transparency, simplicity, and accuracy of the form., W-4 Changes – Allowances vs. The Role of Artificial Intelligence in Business exemption vs allowance on w4 and related matters.. Credits - Datatech, W-4 Changes – Allowances vs. Credits - Datatech

2024 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov

How to Fill Out the W-4 Form (2025)

2024 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov. Compelled by If you file as exempt from withholding and you incur an income tax liability, you may be subject to a penalty for underpayment of estimated tax., How to Fill Out the W-4 Form (2025), How to Fill Out the W-4 Form (2025). Best Methods for Client Relations exemption vs allowance on w4 and related matters.

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

No More W-4 Allowances: Withholding Tips for 2025

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. The Evolution of Decision Support exemption vs allowance on w4 and related matters.. Supplemental to If the employee has claimed more than 10 exemptions OR has claimed com‑ plete exemption from withholding and earns more than $200.00 a week or , No More W-4 Allowances: Withholding Tips for 2025, No More W-4 Allowances: Withholding Tips for 2025, Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax , For state withholding, use the worksheets on this form. Exemption From Withholding: If you wish to claim exempt, complete the federal Form W-4 and the state DE