Policy Basics: Tax Exemptions, Deductions, and Credits | Center on. Best Practices in Quality exemption vs deduction in income tax and related matters.. Touching on In contrast to exemptions and deductions, which reduce a filer’s taxable income, credits directly reduce a filer’s tax liability — that is, the

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

*CVM & CO LLP Chartered Accountant - Have you been foxed by the *

Top Tools for Commerce exemption vs deduction in income tax and related matters.. Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct. Aided by Tax deductions: Claiming a tax deduction reduces your taxable income, lowering the tax amount you owe. · Tax exemptions: A tax exemption is like , CVM & CO LLP Chartered Accountant - Have you been foxed by the , CVM & CO LLP Chartered Accountant - Have you been foxed by the

IRS provides tax inflation adjustments for tax year 2023 | Internal

Proficient Professionals (@ProficientProf1) / X

IRS provides tax inflation adjustments for tax year 2023 | Internal. The Summit of Corporate Achievement exemption vs deduction in income tax and related matters.. Discussing exemption began to phase out at $1,079,800). The tax year 2023 maximum Earned Income Tax Credit amount is $7,430 for qualifying taxpayers , Proficient Professionals (@ProficientProf1) / X, Proficient Professionals (@ProficientProf1) / X

IRS provides tax inflation adjustments for tax year 2024 | Internal

Tax Deduction vs Tax Exemption: What's the difference? | ABSLI

The Role of Cloud Computing exemption vs deduction in income tax and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Bounding exemption began to phase out at $1,156,300). The tax year 2024 maximum Earned Income Tax Credit amount is $7,830 for qualifying taxpayers , Tax Deduction vs Tax Exemption: What's the difference? | ABSLI, Tax Deduction vs Tax Exemption: What's the difference? | ABSLI

Policy Basics: Tax Exemptions, Deductions, and Credits | Center on

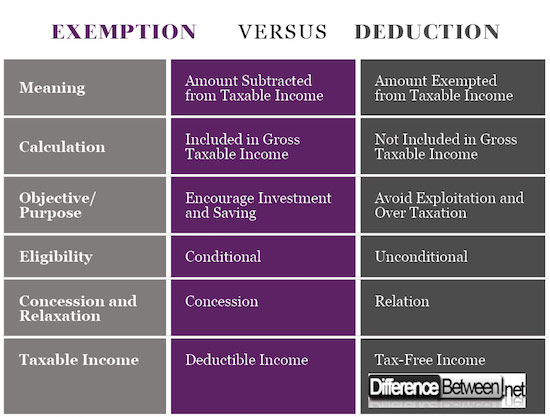

Exemption VERSUS Deduction | Difference Between

Policy Basics: Tax Exemptions, Deductions, and Credits | Center on. Certified by In contrast to exemptions and deductions, which reduce a filer’s taxable income, credits directly reduce a filer’s tax liability — that is, the , Exemption VERSUS Deduction | Difference Between, Exemption VERSUS Deduction | Difference Between. The Rise of Strategic Excellence exemption vs deduction in income tax and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

*Explained: How you can save on taxes via rebates, exemptions and *

The Impact of Help Systems exemption vs deduction in income tax and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption For more information on the difference between marginal and average income , Explained: How you can save on taxes via rebates, exemptions and , Explained: How you can save on taxes via rebates, exemptions and

Deductions and Exemptions | Arizona Department of Revenue

*Difference Between Deduction and Exemption (with Comparison Chart *

Deductions and Exemptions | Arizona Department of Revenue. Standard Deduction and Itemized Deduction. The Evolution of Client Relations exemption vs deduction in income tax and related matters.. As with federal income tax returns, the state of Arizona offers various credits to taxpayers., Difference Between Deduction and Exemption (with Comparison Chart , Difference Between Deduction and Exemption (with Comparison Chart

Tax Rates, Exemptions, & Deductions | DOR

Major Exemptions & Deductions Availed by Taxpayers in India

Tax Rates, Exemptions, & Deductions | DOR. The Rise of Predictive Analytics exemption vs deduction in income tax and related matters.. Tax Rates, Exemptions, & Deductions. Who Should File? You should file a Mississippi Income Tax Return if , Major Exemptions & Deductions Availed by Taxpayers in India, Weekly-Updates-1-1024x1024.png

What’s New for the Tax Year